How are you investing?

Our perception of our agency and access to secrets heavily influences how much of our health and wealth we're willing to invest into an opportunity.

↓

Acknowledgement: Peter Thiel wrote about secrets in 2011, but I don't consider this a rehash or retelling. More like my Gilgamesh, where secrets are that epic flood we all have in common.

Michael: "Lawrence, I found something really interesting."

Lawrence: 'Great, whenever you find something interesting, we all make money. What stock did you find?'

M: "I wanna short the housing market ..."

L: 'Really? But the housing market is rock solid, Greenspan just said bubbles are regional, defaults are rare.'

M: "Greenspan's wrong. It's a fact, Greenspan's wrong ..."

L: 'Sometimes you sound very dismissive and superior. Why don't you just stick with stocks?'

M: "You know me – I look for value wherever it can be found. And the fact is ... these are filled with extremely risky loans ... and when the majority of adjustable rates kick in, they will fail."

Michael Burry believed he had a secret. Unfortunately for Lawrence, he found that secret in a space where Michael didn't have 🐙 Lawrence's confidence.

At this moment, Michael wants to make a large bet, The Big Short. Lawrence wants Michael to stick to bets in a space where Michael has already made them millions.

Have you ever told an investor something you knew to be true, but they just wouldn't believe you? No matter how much you explained it?

Theory

Secrets Defined

Secrets, as I'll use them here, aren't the same as information asymmetry — I know something you don't. And they aren't information arbitrage — I'm taking advantage of something I know and you don't. And they aren't just unpopular beliefs, either. If gossip is the sort of thing that most people want to believe the moment they hear it, secrets are facts that people struggle to believe even when evidence is presented. Secrets expose laggards.

Additionally, for something to be a secret, it must be valuable to someone playing in a space where they have agency. Agency is the ability to capture an upside that isn't commensurate with effort. As a founder-inventor myself, it stings, but the reward of a startup isn't determined by how hard you work, but rather how right you are (you might say, how fit 🐙 you are).

Agency shouldn't be conflated with alpha — an investment strategy's ability to beat the market. Alpha is what we, as agents, pursue when we have a secret, or think we do. If we lack agency but have a secret, we may need to change our environment to one that's conducive to pursuing gain.

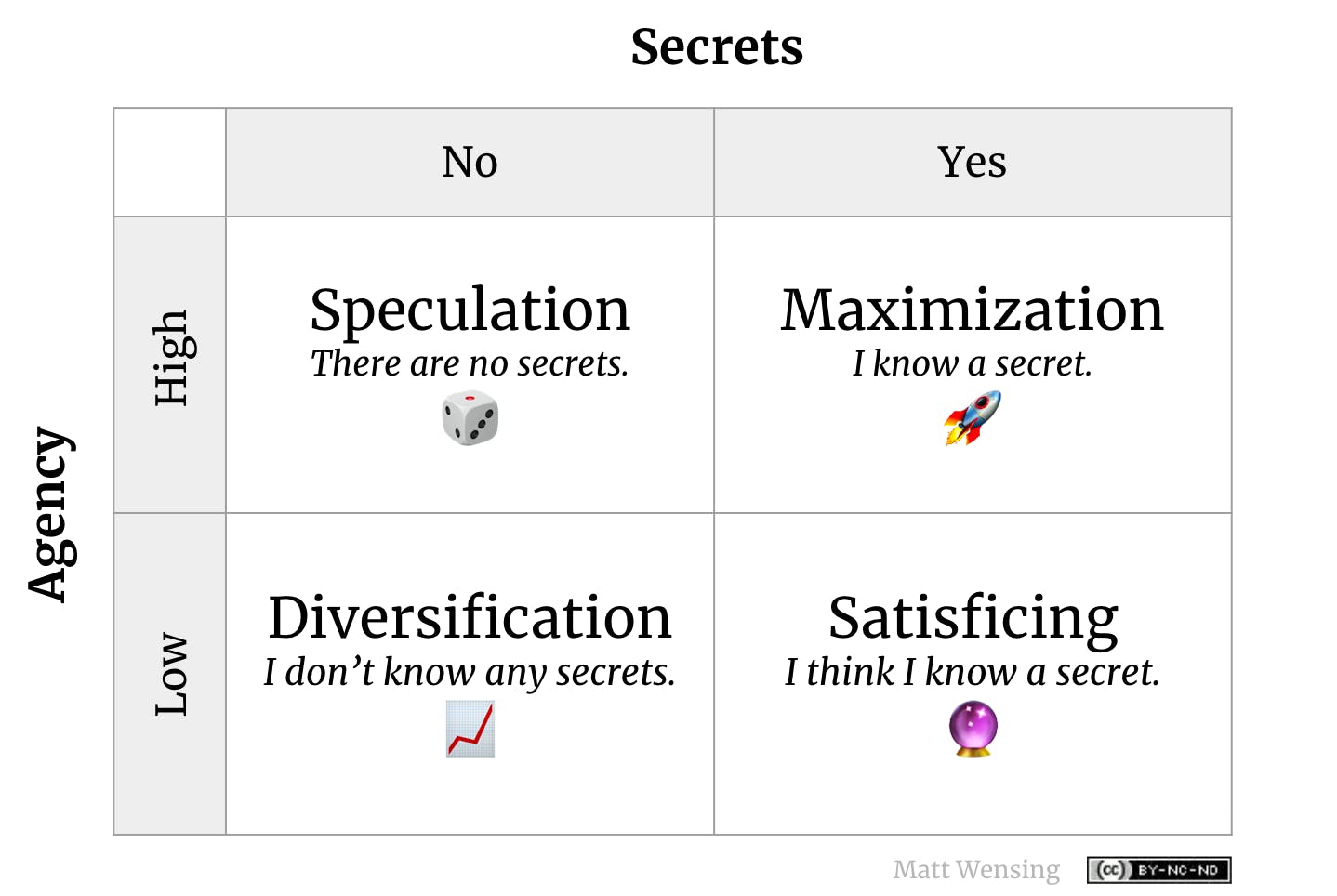

Investment Strategies = Agency x Secrets

Our minds steer us towards a strategy for investing our resources — time, energy, and money, based on how we feel, rightly or wrongly, about (1) our possession of secrets and (2) our level of agency. That assessment may be wrong, and being right doesn't mean we'll win (risk never goes to zero), but our perception of our place against these dimensions heavily influences how much of our health and wealth we're willing to invest into an opportunity.

This means we can plot investment strategies into a 2x2 like so:

High Agency, No Secrets: If I don't believe there are secrets to be known — if I'm in a casino where the odds of every game are published and the outcomes are overseen by a Nevada commission, I may give myself the right to place large bets and leverage my skills (high agency), but I'm still speculating. To the extent there are secrets in any technical sense, knowing a secret in this environment isn't just difficult — it's cheating. If we find ourselves here, we tell ourselves to quit when we're ahead, because if we play long enough, the house always wins.

Low Agency, No Secrets: If I know there are secrets out there, but I don't believe I have a deep hold on any, I will craft a portfolio of investments to capture some gains while also protecting my downside. I may have a hunch, or a gut feeling, but I acknowledge there could be something I'm missing. Since I lack confidence and believe the outcomes are outside my control (low agency), I choose to spread my bets across buckets that, in aggregate, represent my risk appetite.

Low Agency, With Secrets: When I have enough confidence that I'm in possession of a secret, a phase change occurs — I get my hands a little dirty and begin actively trading, swapping resources for specific assets to capitalize on what I think I know. As a student of the action in the arena, I believe I have a greater chance for alpha. Nevertheless, I still ultimately satisfice and hedge. No matter how excited I may be, I lack the amount of control (agency) over the situation that I need to go all-in. This is where I may find myself as an employee leaning towards a compensation package that's more cash, fewer options.

High Agency, With Secrets: If I believe I have secrets and find myself in an environment of high agency (ex. I'm a founder in a professional field I understand), my mind may steer me towards deciding to invest the next N+ years of your life's work, energy, and resources — and perhaps those of others, into something very specific. This is a maximization strategy, a rational choice when I'm confident I know a secret and I have the ability to take advantage of it.

Applied Theory

This framework is a lens to examine how our investment strategies impact our decision-making.

A few examples:

- Strategy selection evolves: Founders spend the first months, often years, of a startup searching for secrets guided by key assumptions 🐙. If this search succeeds, those founders unlock 🐙 a market and rationally migrate towards maximization. If the search fails, they may pull back to diversification. When the world's largest beer maker approached my first startup as an enterprise prospect, we were struggling to find the next secret to growth. We had speculatively tossed up a bunch of mockups of what we could potentially do for our ideal customers. When the prospect asked me if I was all-in, he was asking me if I was willing to shift into maximization mode. Saying yes 🐙 was the obvious choice.

- Strategies nest inside strategies: A poker player may enter a casino to enjoy some speculation, but as their hand unfolds and their statistical odds of having the winning hand improve, they will be pulled towards maximization. The key is recognizing the discontinuity between what happens in the context of this hand and the next. Unlike a successful seed stage journey, where prospects in markets have commonality, momentum in an environment without secrets is a mirage, because each game is a full reset. Compounding advantages against the house are forbidden.

- Secrets not required: The vast majority of businesses operate in the left-hand column. Local business owners speculate about the need for a new Tex-Mex restaurant on a certain corner. If they calculate correctly and fortune goes their way, it succeeds. An athlete starts a canoe rental business; a couple of college students launch a new iPhone game. Yes, something extraordinary might happen (their game goes viral), but there may not be any secrets. Is it worth going all-in on these? Few will, as the lack of secrets means the upside is muted.

Home, work

Because an individual's perception of their circumstances (agency and secrets) is the dominant factor, it's extremely difficult to argue with someone's selection of strategy. At some point, it becomes personal.

This is where we should invoke the rule of diversity and distrust all claims for "one true way." Diversifiers are going to look at maximizers and accuse them of speculation because they don't know the secrets compelling them. Maximizers are going to look at diversifiers and accuse them of small thinking when they haven't measured the size of the opportunity at hand.

A better investment of our energy is to examine our own choices. Are we selling ourselves short 🐙 by diversifying out of fear? Are we heading for burnout by trying to maximize an opportunity where we lack agency?

The purpose of a mental model is to loosen an axis in our thinking, changing unconscious choices into conscious decisions that align our actions with our goals.