What are you asking people to do?

↓

I wanted to figure out how to preface this, because generalizations are dangerous, and absolutes are even more so — but, screw it, it's a model anyway (if it doesn't help, throw it out):

Startups find fit when the market (1) understands their first-order object, i.e. the Thing they contribute to the network, and (2) accepts the method of access to that Thing.

Fit is Thing via interface.

Access-Risk Startups

Companies that begin with a familiar Thing can focus all of their marketing and product energy on the method of access — the way value of the Thing gets transmitted, i.e. the interface.

For example:

- Uber → rides via mobile app

- Facebook → profiles via social network

- Twilio → texts via API

- eBay → items via auction site

- Salesforce → contacts via cloud

- Netflix → movies via U.S. mail

All of these once-startups are now mega-corps whose purviews go far, far beyond these narrow definitions. But these were the shapes of the horses 🐙 allowed in to their markets.

Through this Thing via interface lens, you can see what their challenges might have been. The Thing is familiar, so it's all about the access:

- Uber → will anyone use our mobile app?

- Facebook → will their friends be on our site?

- Twilio → will developers use our API?

- eBay → will our auction have liquidity?

- Salesforce → will people want a cloud?

In Netflix's case, it was market infrastructure risk:

- Netflix → will DVD's survive the postal system?

Again, none of these companies took a risk on the Thing (ex. Netflix didn't start by trying to make better movies). Instead, they were all bets that the market would accept and support their new method of accessing an already-understood-to-be-desirable Thing.

Thing-Risk Startups

Other companies choose to burn an innovation token on the Thing itself, which you may find more or less terrifying:

- Fair Isaac Company → credit scores via request

- Zillow → Zestimate via website

- Masterworks → fractional art ownership via investment

In these cases the risk isn't that people won't accept the method of access, it's that they won't understand the Thing, so they won't bother to use the method, even though it's familiar.

My gut says this is the harder mode. If people recognize the Thing, they might exert enough effort to learn how to access it. But if the Thing is foreign, the conversation can often stop there.

Yet, what this mode loses in ease-to-market, it gains in defense-in-market. FICO scores and Zestimates are proprietary formulations of data that power entire industries and to some extent the world economy. And to get one, you must request it from them. This is Buffett's toll bridge dream.

Thing- && Access-Risk Startups

So if your startup is a function, you can either be risky on the signature of the function, or on the type of thing it returns.

You should not be risky on both. Unless, well ...

- VisiCalc → digital spreadsheets via personal computer

- AutoCAD → digital drawings via computer-aided design

- Bitcoin → cryptocurrency via blockchain

I realize Bitcoin is not a company, but I didn't want to leave you only with two examples of beating the tremendous odds here (braces for impact).

Yes, personal computers are familiar to us, but when VisiCalc got started they were not. And the first people to see spreadsheets reportedly didn't know what to do with them, even and especially the financiers that were skilled with ledger paper. Good enough was good enough.

Autodesk had to simultaneously bring computer-aided design (new access) and a new file format (new thing) to market.

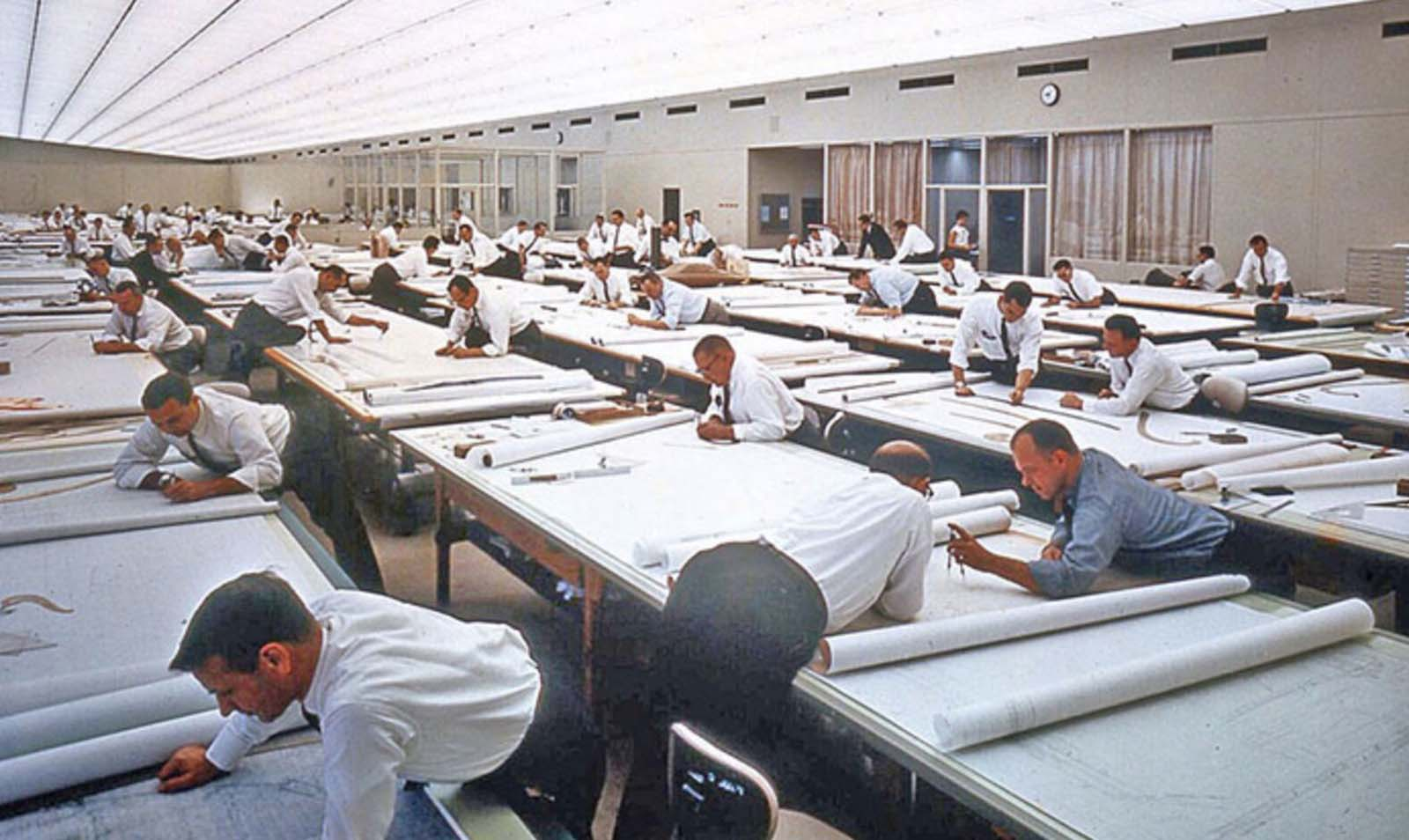

Before you say that a digital drawing file is "just the digital version" of a familiar thing, consider this is what an architect's office looked like before:

And this is what they wanted to get people to switch to:

Today, Autodesk has a market cap of $43 billion.

Innovation Tokens

Which type of startup are you? Where are you spending your innovation tokens — those risks you choose to take in order to create upside?

What are you asking people to do? Are you asking people to get a Thing they already know they want in a new and better way? Are you asking people to learn to want some new Thing in a familiar way? Or are you asking them to get a new Thing in a new way?

If we know what we are, are we investing our energy, time, and talents on de-risking the risky part? Or are have we slipped into just having fun while enhancing the familiar?

Clarity on these questions is the precursor to fit because it means we know our risks. And once our risks are known, they can be mapped 🐙, attacked, and reduced.