What shape is your market?

↓

I confess: I've pitched a lot of investors.

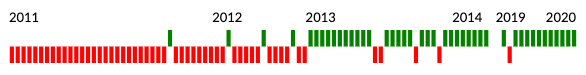

This damp, twisted bail receipt belongs to me:

Each stroke is an investor pitch. Each red is when they didn't fund me. Each green is when they did.

One thing investors want to hear about in pitches is your market size: "how big can this get?" "How large is your addressable market?" "How about your accessible market?"

(Truth be told, if they ask you any of these questions, you've already lost, but let's keep going.)

These questions are horrific crimes against the complexity of markets because, assuming their reptile brains (no offense, we all have them) want to hear anything at all, it's some giant number. Billions and billions ...

These giant numbers are checksums for them to (theoretically) decide if you're investable.

If you're going to get to fit (which is what actually makes you investable — and frankly your whole life better, whether or not you take funding), you'll need to start with the decompressed version of your market.

Pain Illustrated

Let's play a game.

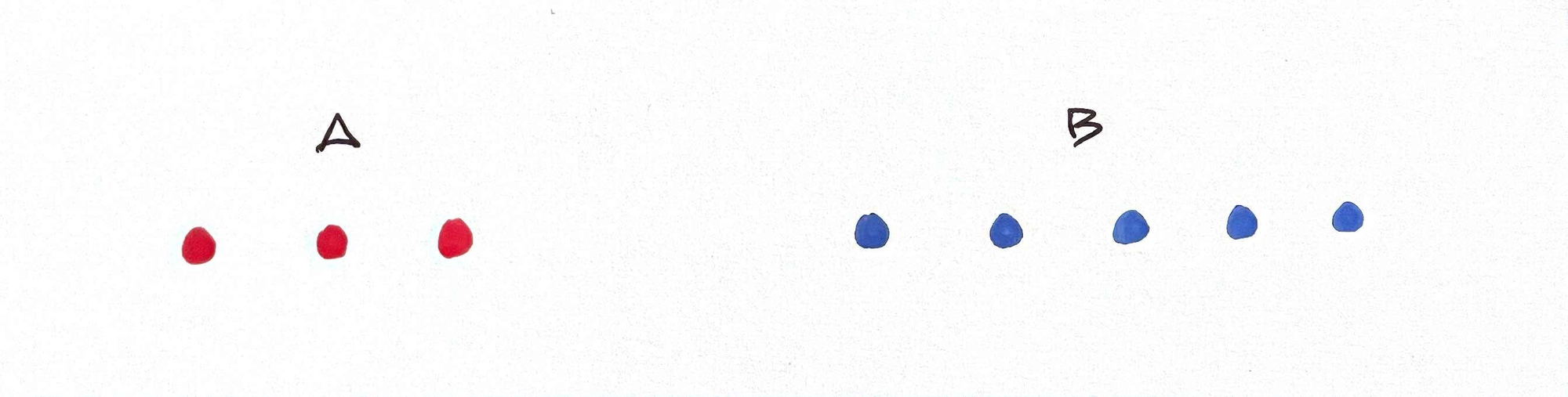

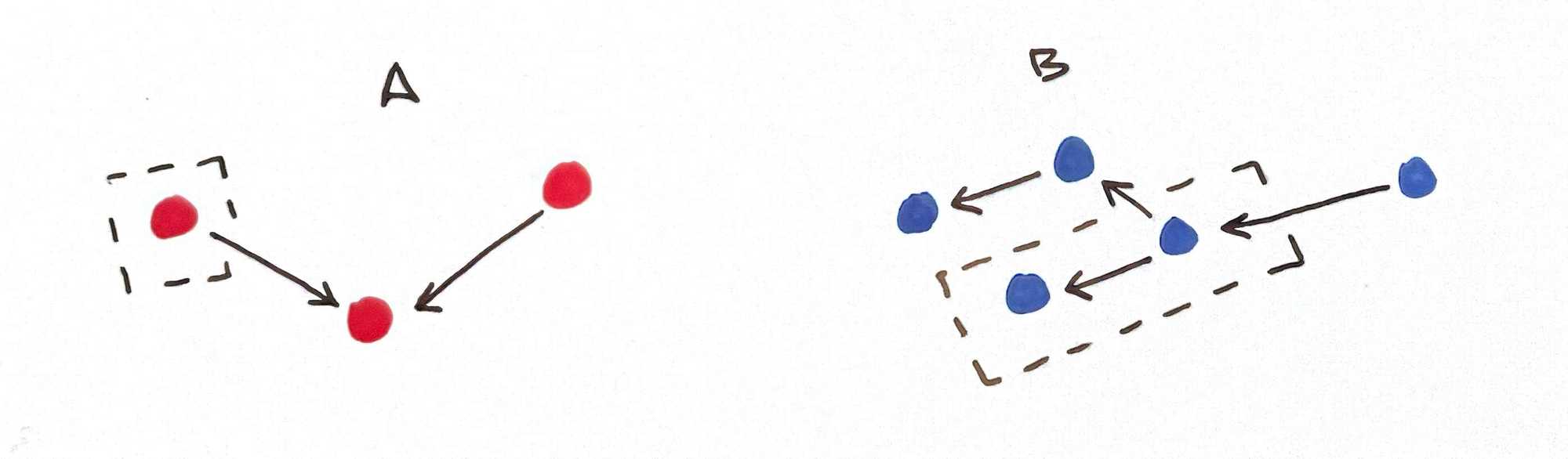

Assuming a market size of 1, which do you want? Red is more pain, blue is less pain:

Child's play: A. More pain is better! But now let's add some more prospects:

Hmm, okay, yes, I still choose A, but it's a closer call.

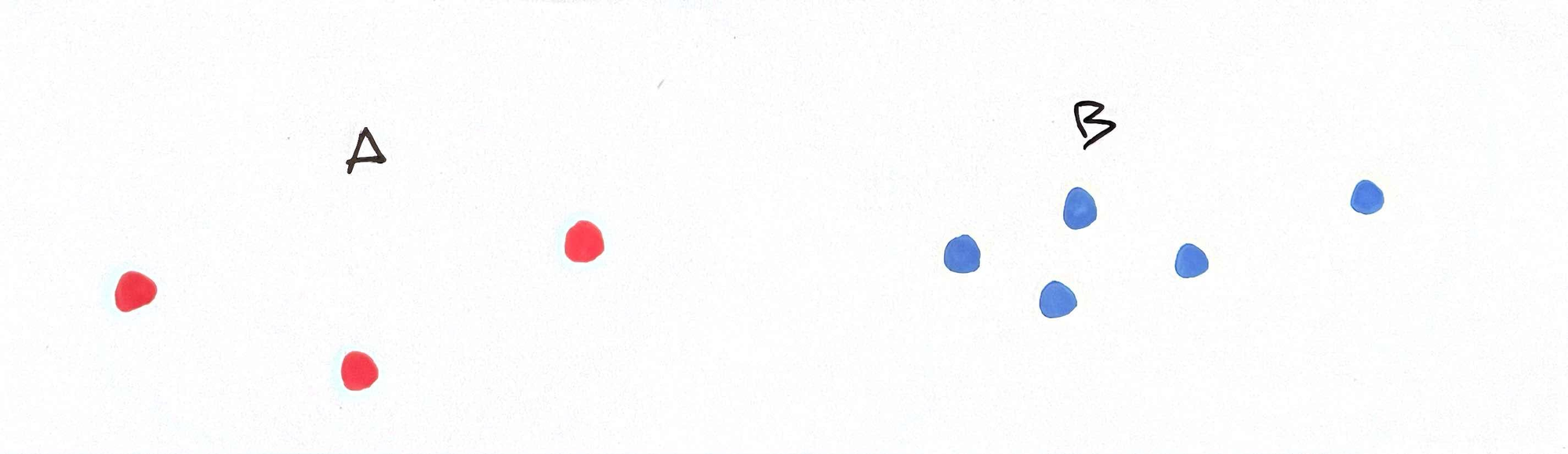

Now let's add some spacing to indicate how far apart these people are from each other.

Naturally, we have some clustering now. Which is better? Personally, I don't know anymore. "A" looks high value but "B" looks more, friendly in that little dipper sorta way.

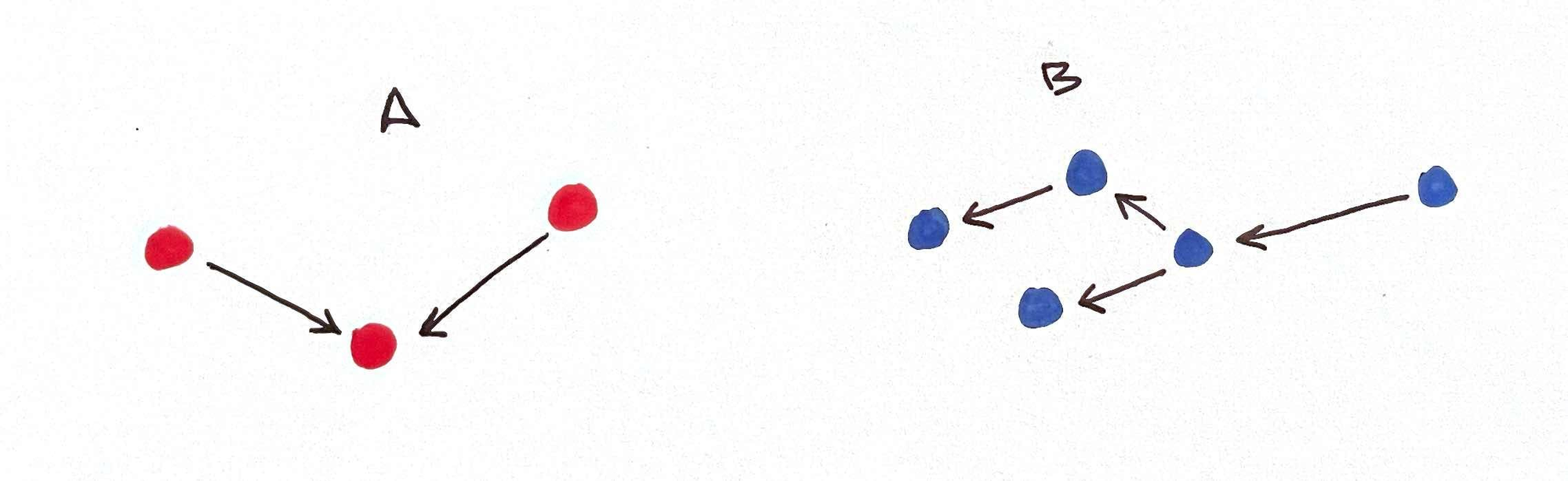

But wait! Let's add arrows to indicate the flow of information between your potential buyers. And lets only do it if the receiver (at the pointy end of the arrow) actually cares what the other person thinks:

Now let's draw a dotted lasso around the ones you have in your 1st degree network.

General Specific

An investor experiences a market through the numbers in their spreadsheets: so the larger a sum, the better.

But as founders, we experience markets through approach and execution. Yes, all things being equal, more dots is better (!) — but all things are not equal, are they?

Is the shape of your market conducive to your approach? Is the pain tightly or broadly distributed? Who talks to whom, when and where and how often?

Re-shaping markets is a rare feat, facilitated by network and platform effects at-scale. But these are the very things your pre-fit startup doesn't have.

Lacking the resources to move mountains, you need to select the terrain that makes the most of your unfair advantages: your speed, your decisiveness, and your willingness to go all-in on a narrow space others have ignored 🐙.